We would like to show you a description here but the site wont allow us. However such GST paid is also allowed as Input tax credit in same month and therefore net liability of tax will not increase.

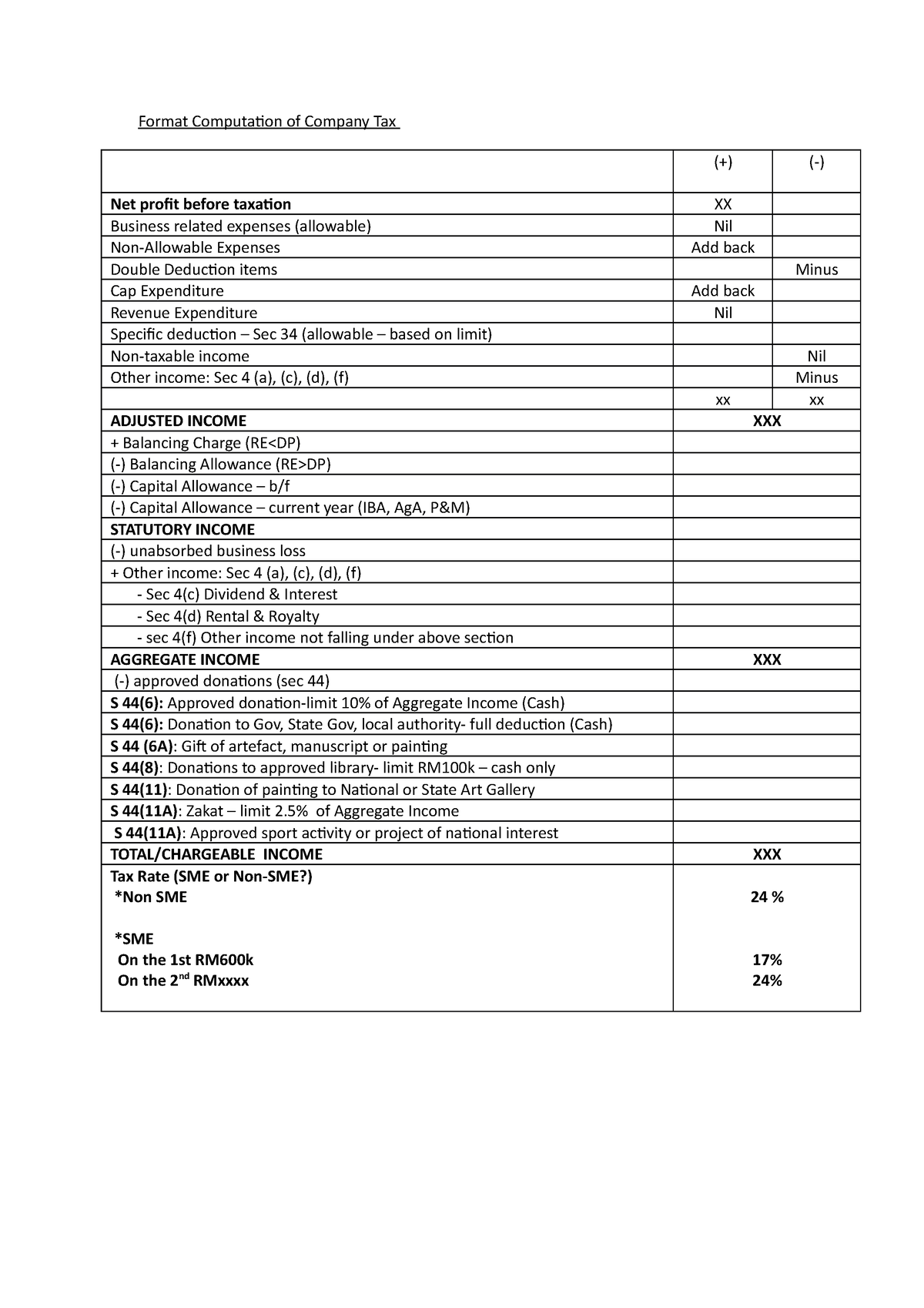

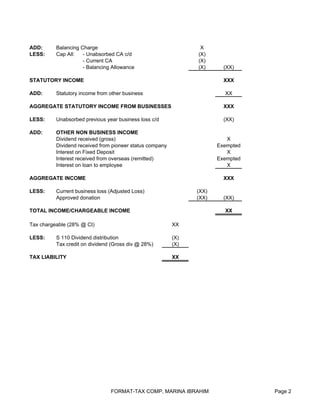

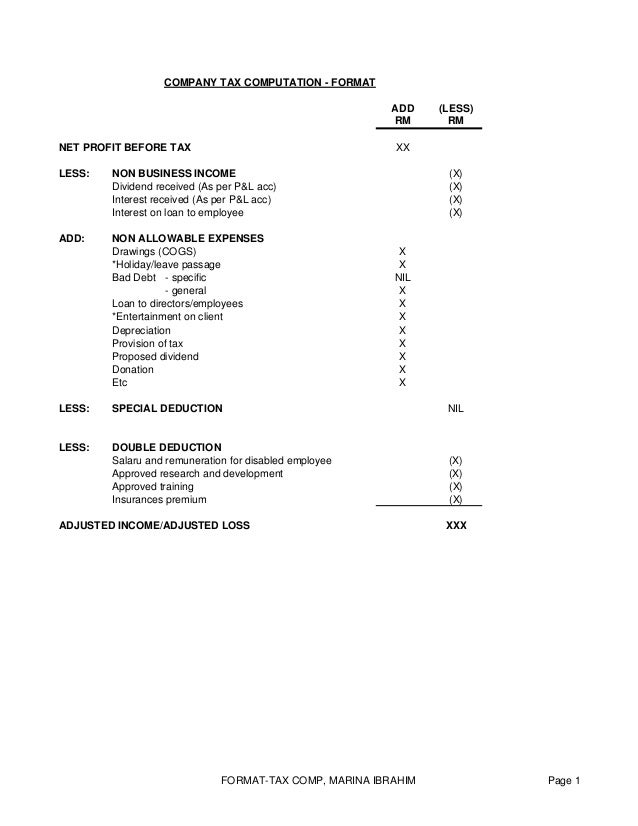

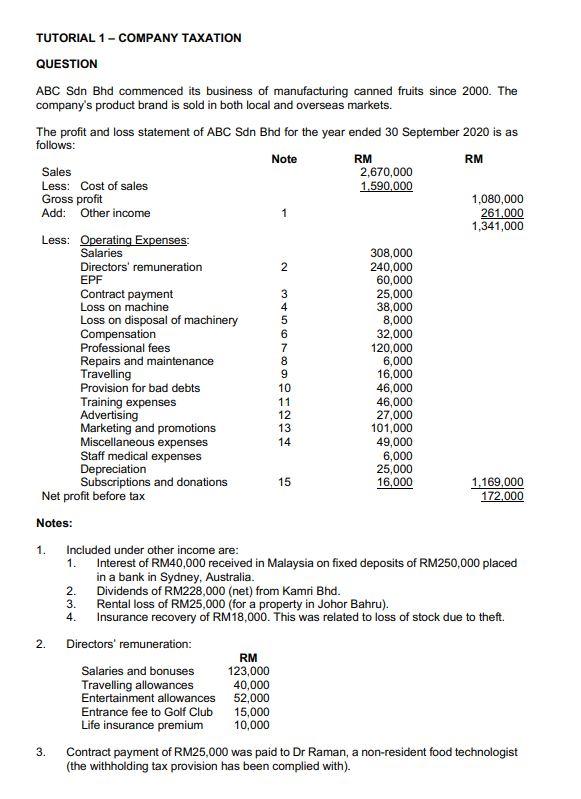

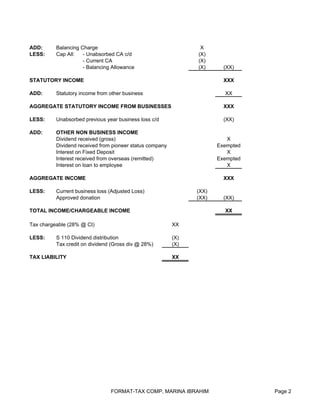

Format Computation Of Company Tax Format Computation Of Company Tax Format Computation Of Company Studocu

My business permit says im a retailer although my company name includes services.

. Sukanya Samriddhi Yojana Calculator. HRA or House Rent allowance also provides for tax exemptions. SOP Statement of Purpose.

The different Sections of the Income Tax Act help the salaried individuals and the self-employed people and professionals to make their rent expenditures cheaper and more desirable. We will guide you on how to place your essay help proofreading and editing your draft fixing the grammar spelling or formatting of your paper easily and cheaply. Now i would like to know how to fill-up the service invoice whenever we have.

Xero Tax displays the company information stored at Companies House. Otherwise the report should be presented using 12pt font with 115 or 15 line spacing. It makes a perfect savings scheme that parents can buy to give.

Allow multiple user to access and update a clients file concurrently. This determination of the sale price may be referred to as the transfer price. The amount of net periodic benefit cost recognized for each period for which a statement of income is presented showing separately the service cost component the interest cost component the expected return on plan assets for the period the gain or loss component the prior service cost or credit component the transition.

UNLIMITED clients and users. Bir issued atp to us service invoice instead of sales invoice. IRAS compliant EasyPay is complies with IRAS technical file format specifications to ensure that the format of the files records generated from the payroll software can be accepted by IRAS.

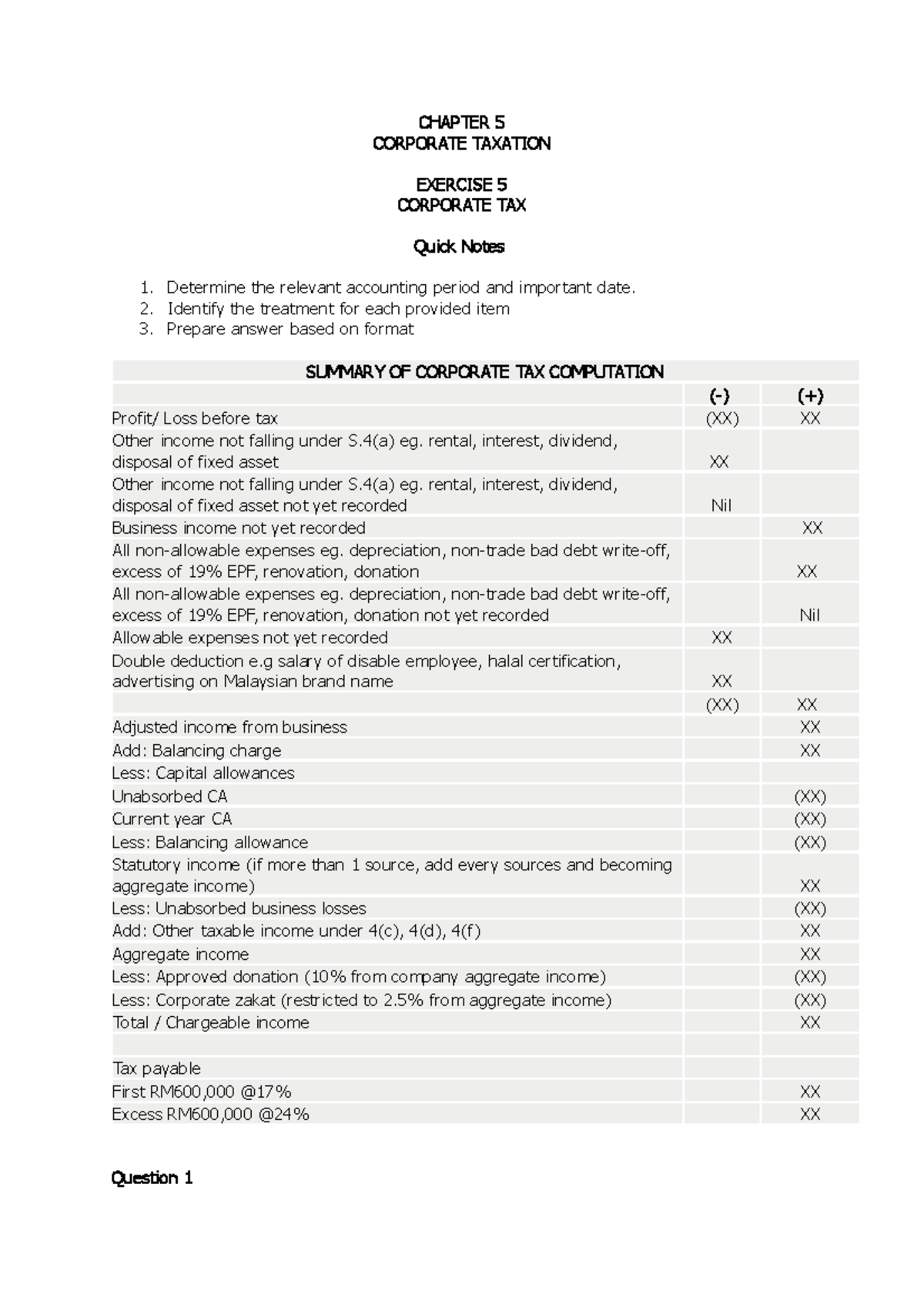

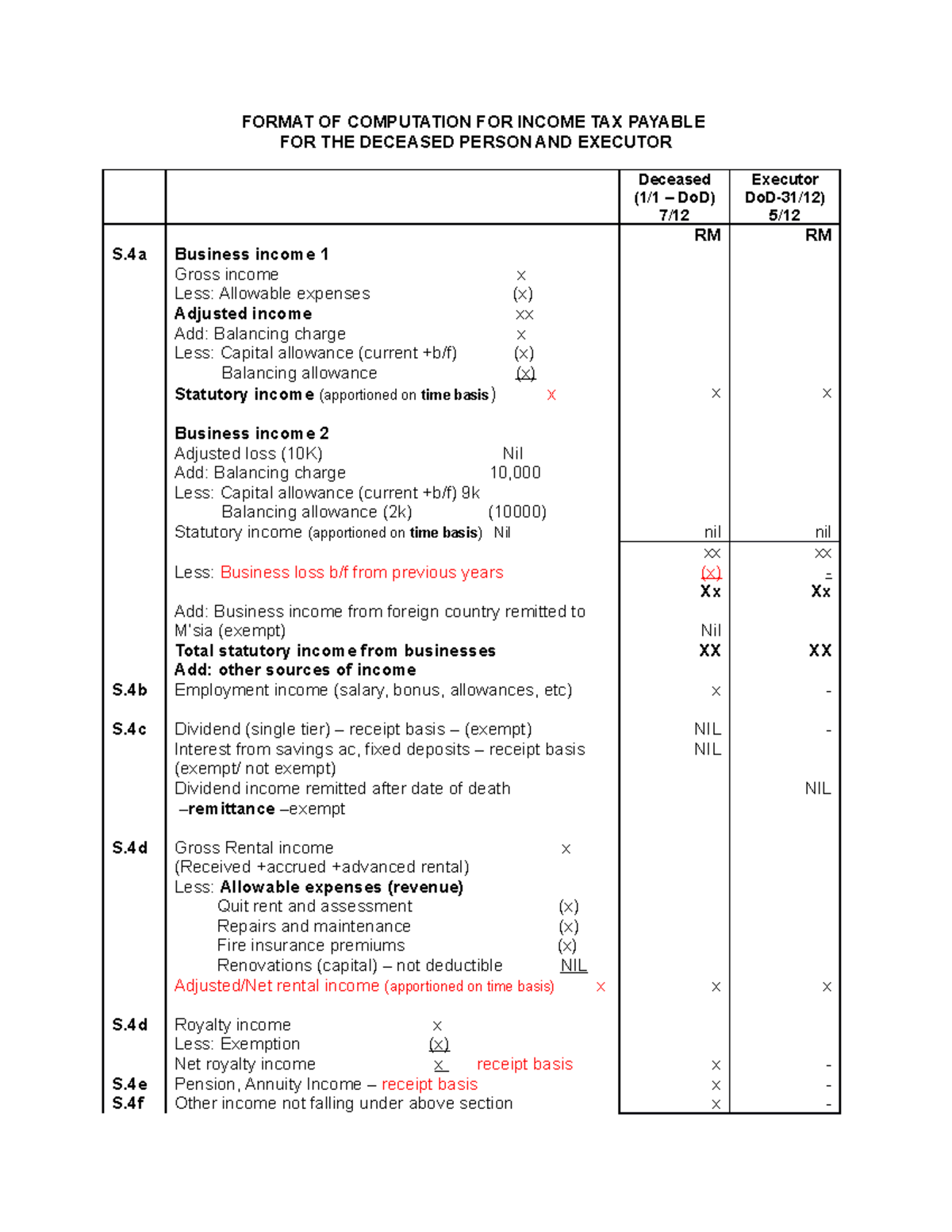

MALAYSIAN TAXATION 2 covers tax computation for partnership and company which includes the deductions of capital allowances and investment incentives as provided under the tax laws and continues with computation of real property gains tax and indirect. BCom Computers Subjects 2nd Year. Inclusive of Personal e-Filing.

This course exposes various types of business documents and format which also emphasizes. Mobile TaxComp - Allow users to compute TaxCompe-filing at anytime and anywhere. Get 247 customer support help when you place a homework help service order with us.

Controlled company - interpreted under Section 2 Income Tax Act 1967 ITA 1967 as a company having not more than fifty members and controlled by not more than five persons in the manner described by Section 139 ITA 1967. The new IIT law will take effect with full implementation from January 1 2019. Article contains Automatic Income Tax Calculator in Excel Format for Financial Year 2022-23 FY 22-23 ie.

Miguel de Serpa Soares the Under-Secretary-General and United Nations Legal Counsel. Check company information and statutory filing deadlines. Compliant and up-to-date with local legislation in Singapore Malaysia Hong Kong Indonesia Thailand Philippines and Brunei.

Company Law Income Tax Law Managerial Economics E-commerce. The report should have a heading in a larger font size followed by your name and student number in 12pt font. 102 with CommerceScience.

Under this scheme a girls guardian can open a savings account in her name with an authorized Indian post office branch or a commercial bank. This service is listed under the reverse charge list therefore trader has to pay tax 18 on Rs. The selling price of a product charged by the parent company to the subsidiary company may differ from the selling price with an independent third party.

Tax Guru is a reliable source for latest Income Tax GST Company Law Related Information providing Solution to CA CS CMA Advocate MBA Taxpayers. Sukanya Samriddhi Yojana SSY was launched in 2015 by the government of Indian as part of the Beti Bachao Beti Padhao Campaign. 1 2018 September 2018 On August 31 2018 amendments to the Individual Income Tax Law IIT Law have been passed by the Government of China.

Excerpt from ASC 270-10-50-1j. Electronic filing and thousands of automatically calculating forms and schedules speed up your tax preparation and review process giving your staff more time for consulting with clients and growing your business. Salaries of the employees of both private and public sector organizations are composed of a number of.

Example A trader who is registered in GST takes services of Goods Transport Agency GTA for Rs. Automate your tax return process with CCH ProSystem fx Tax our award-winning tax prep and compliance software solution. 08 EFTPS does not change the computation of tax liability interest or penalties or FTD or FTP due dates.

You can edit the format of the company name and directors names if you dont want to use the Companies House format. Click the preview icon to view the accounts tax return or tax computation summary in document format. Acting on the recommendation to prevent erosion of Indias tax base the Income Tax Act 1961 was amended in April 2001 by substituting the existing section 92 and inserting sections 92A to 92F to introduce Indian transfer pricing regulations TPR in line with Article 9 of the Organization for Economic Co-operation and Development.

Format Samples and Tips Team. The list must be submitted in the format prescribed in section 605 of this revenue procedure and to the address or fax number provided in section 606 of this revenue procedure. Article 9 OECD Model Tax Convention On Income and On Capital - OECD defines related companies as.

It will also be the basis of the output tax liability of the seller and the input tax claim of the buyer. Income from Other Sources Clubbing of Incomes Deduction from Gross Total Income Computation of Tax Liability of Individuals. If not using the IEEE format then Harvard preferably Swinburne referencing is expected.

Defined value DV DV value for real property means market value of the real property. New tax exemption and the tax table of Individual Income Tax effective from Oct. Income Tax Assessment Year 2023-24.

Format Computation 1 Xlsx Computation Of Chargeable Income Tax For Ya Xxxx Husband Wife S 4 A Business Income Adjusted Income Add Balancing Course Hero

Company Tax Computation Format 1

Pioneer Status Investment Tax Allowance And Reinvestment Allowance Acca Global

Company Tax Computation Format

Chapter 5 Tutorial Taxation Chapter 5 Corporate Taxation Exercise 5 Corporate Tax Quick Notes Studocu

Joint And Separate Assessment Acca Global

Tax Computation Format Lessor Company Name Computation Of Chargeable Incom For Ya Xxxx Rm Leasing Business Gross Income Less Wholly Exclusively Course Hero

Tutorial 1 Company Taxation Question Abc Sdn Bhd Chegg Com

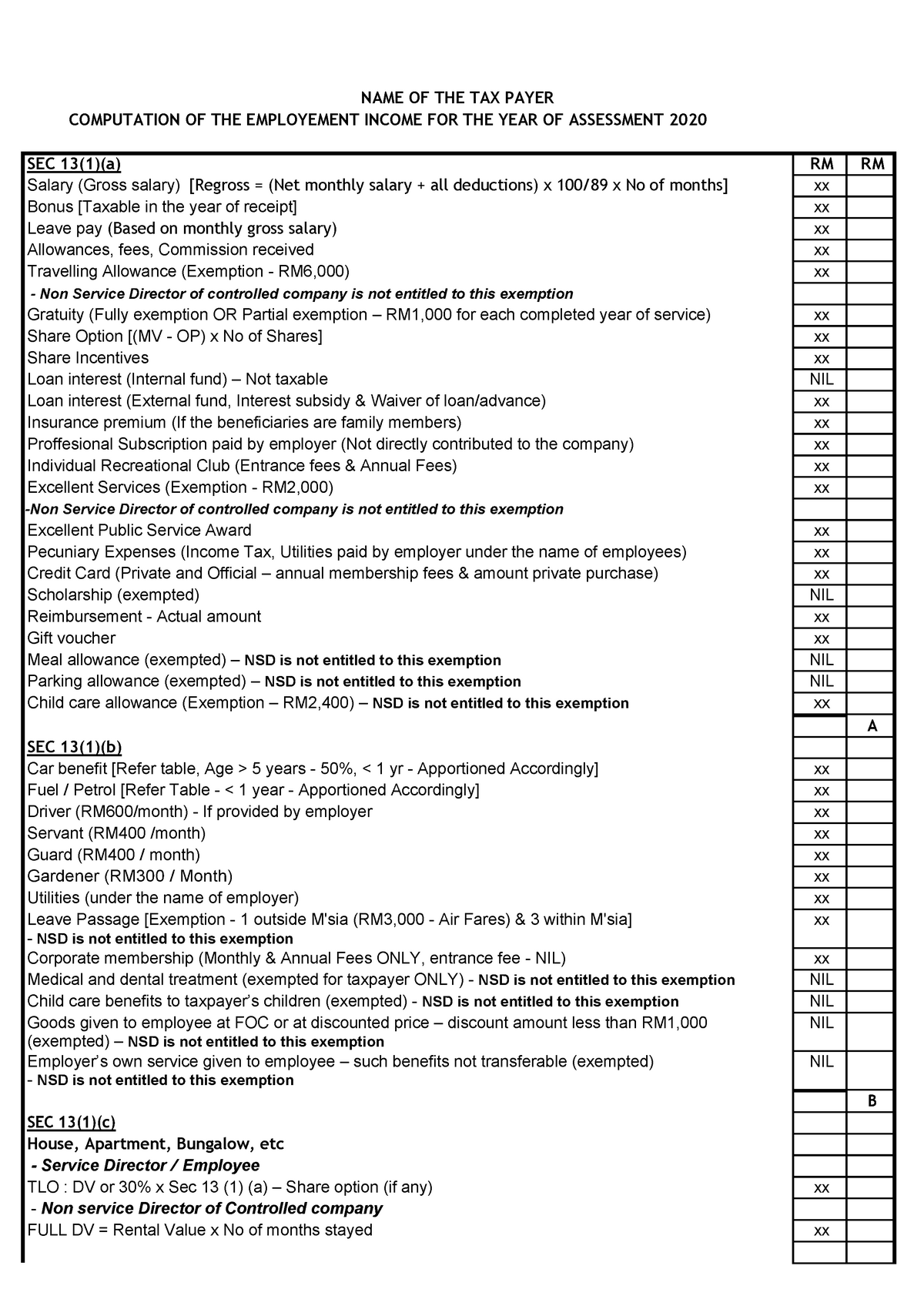

Format Employment Income Ya 2020 Name Of The Tax Payer Computation Of The Employement Income For Studocu

Chapter 8 Business Expenses And Tax Computation For Companies Chapter 8 1 Business Expenses And Tax Computation For Companies Companys Course Hero

Pioneer Status Investment Tax Allowance And Reinvestment Allowance Acca Global

Computation Format For Individual Tax Liability For The Year Of Assessment 20xx Docx Computation Format For Individual Tax Liability For The Year Of Course Hero

Tax Computation Format Malaysia Jaroncxt

Malaysia Taxation Junior Diary Investment Holding Charge Under 60f 60fa

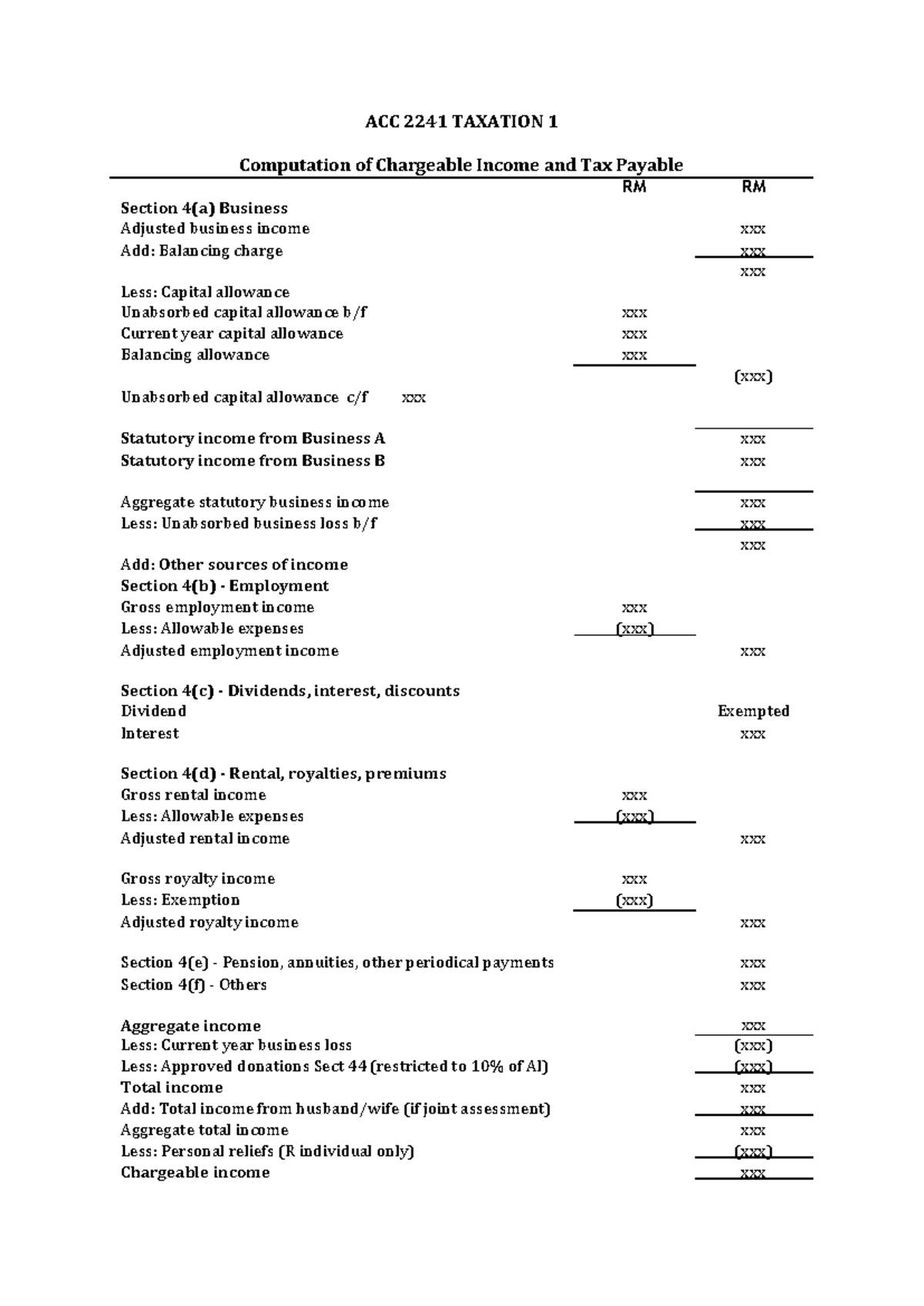

Acc 2241 Format For Chargeable Income Acc 2241 Taxation 1 Computation Of Chargeable Income And Tax Studocu

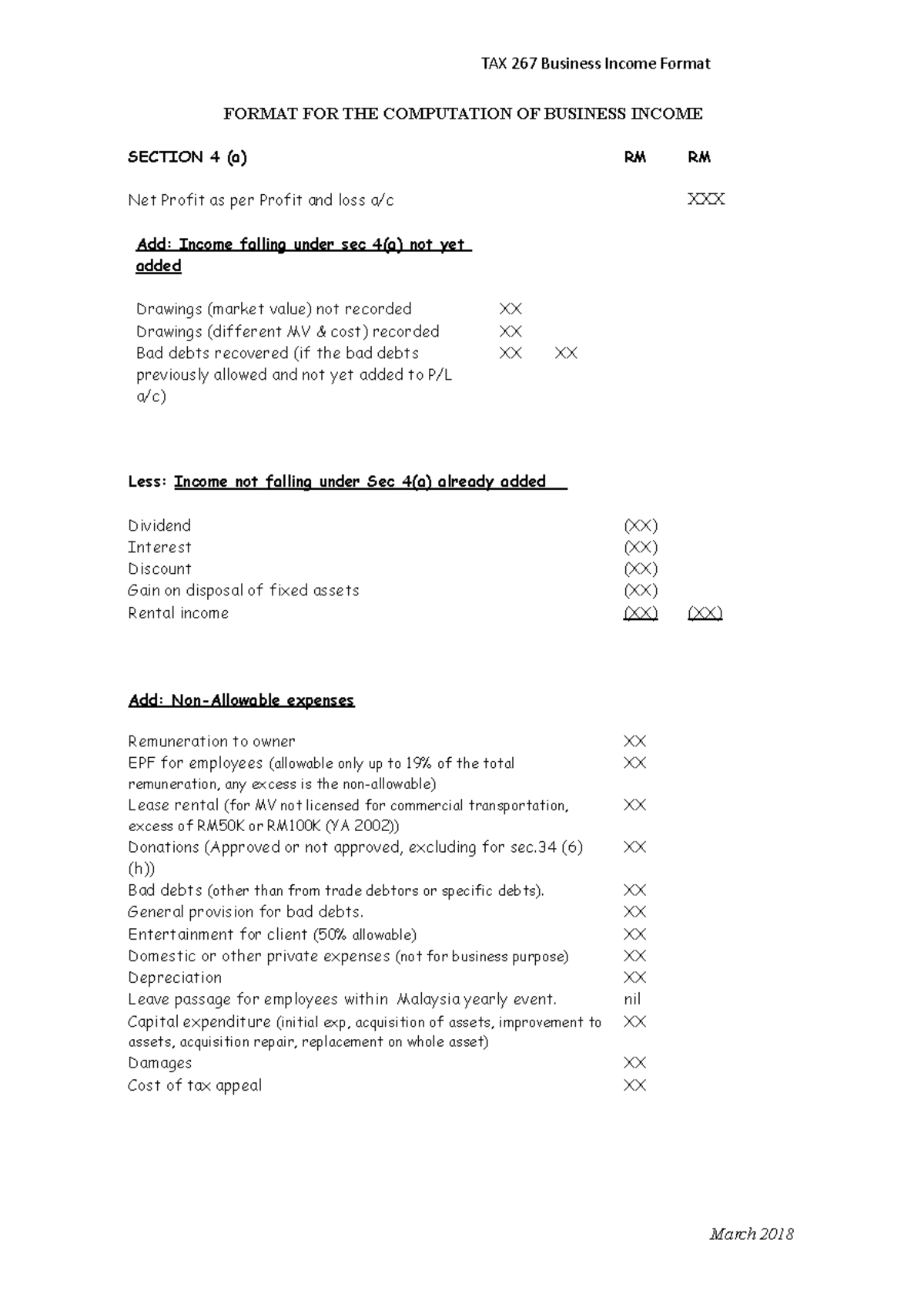

Format For The Computation Of Business Income Tax 267 Business Income Format Format For The Studocu

Company Tax Computation Format

Computation For Individual Tax Liability For The Year Of Assessment 2019 Format Of Computation For Studocu

Malaysia Taxation Junior Diary Non Income Producing Dormant Inactive